Business Banking

Find robust solutions designed to support your business’s growth at Community Savings.

The Community Savings Difference

SecureSupporting businesses for over 100 years with strength, stability, and services. |

CompetitiveCompetitive rates to boost your returns so you can continue to grow. |

ComprehensiveA range of products designed for businesses, so you have everything you need. |

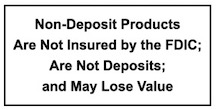

| Business SavingsIf you’re looking for a savings option that aligns with your business’s financial goals in the long-term, a business savings account is the way to go. 4.35% APY*Features:

|

Experience small business accounts that make sense for today’s busy entrepreneurs.

*Annual Percentage Yield – APY Annual Percentage Yields (APYs) are accurate as of 04/02/25 and are subject to change without notice. Fees on deposit accounts may reduce earnings. Minimum deposit to open an account and minimum balance to obtain an APY are indicated on our business rates page here.

Business Certificate of DepositCertificates of Deposit (CDs) from Community Savings are a great way to achieve your savings goals.

4.40% APY* | 12-month CD |

|

Need flexibility? We offer short & longer-term CDs to make an impact on your timeline.

Our CDs provide the ultimate flexibility, allowing you to create custom terms that fit your lifestyle.

And with minimum opening balances as low as $1,000, now is the time to start making your money work for you.

|  |  |  |  |  |

*CDs are subject to penalty for early withdrawal. A $1,000 minimum deposit is required to open an account. Rates effective as of 04/02/25 and are subject to change without notice.

Community Savings Business Credit Cards

Get to know the ultimate business advantage: your new business credit card from Community Savings. You can keep your business spending separate and unlock additional funding flexibility.

Flexible Options with Full Reporting

|

Security that has Your Business’s Back

|

Service from the Community

|

*See the card application’s Important Disclosures for current terms, rates, and fees. This card is issued by TCM Bank, N.A. Subject to credit approval. ¹Coverage applies when the entire cost of the fare (less redeemable certificates, vouchers, or coupons) has been charged to the card. Your account must be in good standing. Restrictions to coverage may apply.

Mobile Banking SimplifiedEnjoy the freedom of mobile banking and so much more with Community Savings. We offer a variety of convenient services to make your life a little easier. |

|