Wholesale Lending

For Mortgage Professionals Only

Non-QM Made Simple

Specialized Loan Programs to Fit Your Borrowers Needs

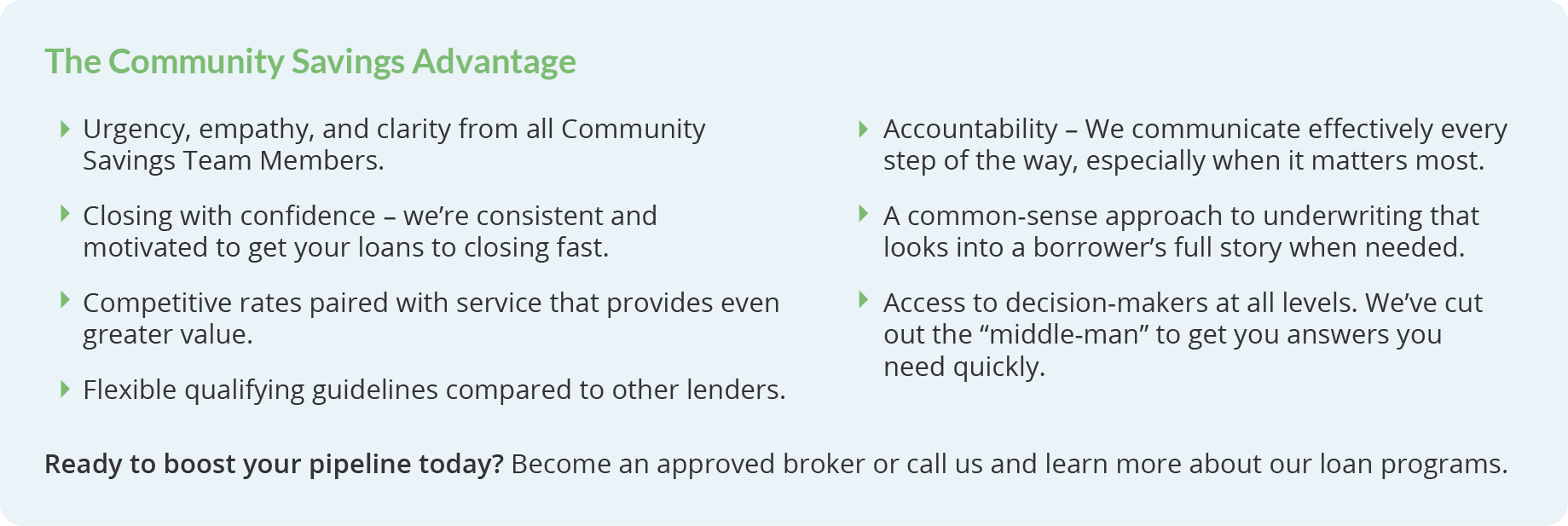

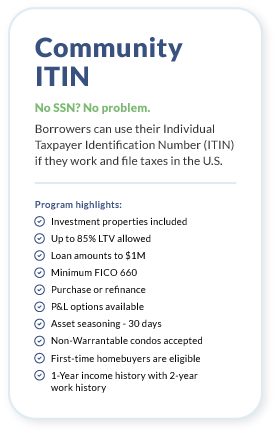

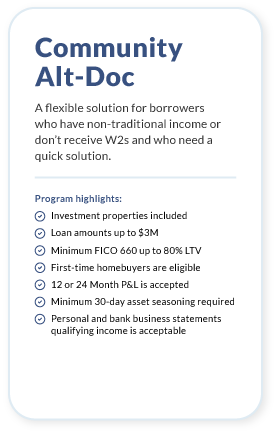

We’re not your average bank. The Community Savings Wholesale Lending Team provides access to our Non-QM lending programs for your non-traditional wage earners and/or non-agency qualifying borrowers, including our sought-after ITIN loan programs up to 85% LTV.

The secret to our success is in our experienced Non-QM wholesale lending team and our highly efficient process. We excel at deal structuring and underwriting by looking at your borrower’s non-traditional credit profiles differently. When other lenders say, “No,” we say, “Yes.”

Non-QM Loan Programs Overview

Showcasing our deal-saving loan programs.

|    |

Homeownership Counseling

Affordable classes with an easy process for your borrowers.

Classes are offered by select vendors. Fees begin at $75.

https://learn.frameworkhomeownership.org/mycommunitysavings

Resources

| Frequently Used Forms | Training Guides |

|---|---|

Have questions? Reach out to the Scenarios Team

Currently Serving the States of:

- Connecticut

- Florida

- New Jersey

- New York

- Ohio

- Pennsylvania

States updated periodically. Check back frequently.

Contact Us

Wholesale Lending Team

Phone: (980) 580-6007 / Toll Free 1-800-467-0064

Email: cswholesale@mycommunitysavings.com

Partner With Us Ask A Question

Equal Housing Lender. NMLS# 812294